What would happen if a hurricane damaged your home and you discovered your insurance deductible was thousands of dollars higher than you expected?

Understanding Hurricane Insurance

Hurricane insurance isn't a standalone policy but rather a collection of coverage options within your home insurance that protects against damage from hurricanes and tropical storms. Understanding these coverages is crucial for homeowners in hurricane-prone regions, as standard policies often include special provisions, deductibles, and exclusions specifically for hurricane-related damage.

Hurricane damage can be devastating, making proper insurance coverage essential

The complexity of hurricane insurance stems from the multiple types of damage these storms can cause—wind damage, water damage from rain, flooding from storm surge, and more. Each of these may be covered differently or require separate policies, creating potential gaps in coverage that homeowners need to understand.

Wind Damage Coverage

Wind damage from hurricanes is typically covered under standard homeowners insurance policies, but with important considerations:

- Standard Coverage: Most policies cover damage from strong winds, including hurricanes.

- Regional Variations: In some high-risk coastal areas, wind damage may be excluded from standard policies.

- Separate Wind Policies: In certain coastal regions, homeowners may need to purchase separate windstorm insurance.

- State Programs: Some states have special programs (like Florida's Citizens Property Insurance) to provide wind coverage.

Wind damage typically includes harm to roofs, windows, siding, and other exterior elements caused by hurricane-force winds. It also generally covers damage from falling trees and debris.

Water Damage Coverage

Water damage from hurricanes presents more complex coverage scenarios:

- Rain Damage: If wind damages your roof and rain enters, this is typically covered.

- Storm Surge: Damage from ocean water pushed ashore during a hurricane is NOT covered by standard policies.

- Flooding: Any flooding from hurricane rains or storm surge requires separate flood insurance.

- Mold: Mold resulting from covered water damage is typically included, but with limitations.

One of the most common misconceptions about hurricane insurance is that it covers all water damage. In reality, standard homeowners policies specifically exclude flood damage, making separate flood insurance essential for comprehensive protection.

Understanding Hurricane Deductibles

Hurricane deductibles represent one of the most significant differences between standard homeowners insurance and hurricane coverage:

- Percentage-Based: Unlike standard deductibles with fixed dollar amounts, hurricane deductibles are typically 1-10% of your home's insured value.

- Higher Costs: For a $300,000 home with a 5% hurricane deductible, you would pay $15,000 out of pocket before coverage kicks in.

- Trigger Events: These deductibles apply when a hurricane is officially named by the National Weather Service.

- State Regulations: Some states like Florida mandate specific deductible options (typically $500, 2%, 5%, or 10%).

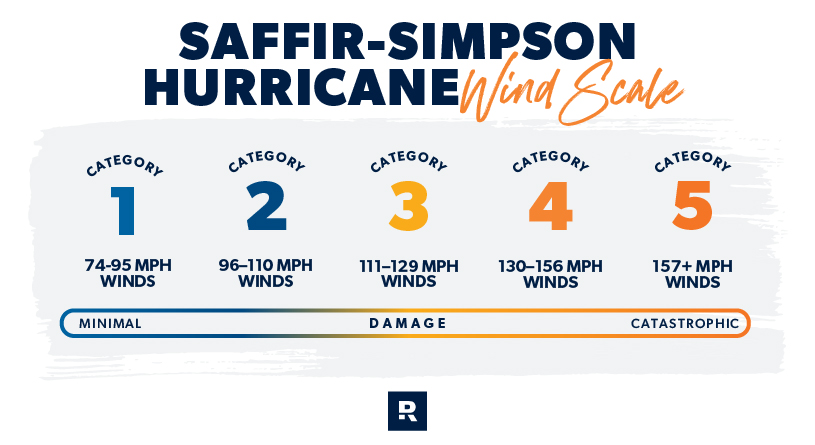

Hurricane categories help determine potential damage and insurance considerations

These higher deductibles help insurance companies manage the substantial costs associated with hurricane claims, but they can create significant financial burdens for homeowners who may not be prepared for these out-of-pocket expenses.

Named Storm vs. Hurricane Deductibles

Insurance policies may include different types of storm-related deductibles:

- Hurricane Deductible: Applies only when a storm is classified as a hurricane at the time of damage.

- Named Storm Deductible: Applies to any storm that has been named by the National Weather Service, including tropical storms.

- Wind & Hail Deductible: May apply to any wind or hail damage, regardless of whether the storm was named.

The key difference is when these deductibles trigger. A hurricane deductible only applies while the storm maintains hurricane strength, while a named storm deductible applies throughout the storm's lifecycle, from when it's first named until it dissipates.

Business Insurance Considerations

Businesses in hurricane-prone regions need specialized coverage beyond standard property insurance:

- Business Interruption: Coverage for lost income during evacuation and recovery periods.

- Extra Expense Coverage: Costs to continue operations at a temporary location.

- Contingent Business Interruption: Protection when suppliers or customers are affected by hurricanes.

- Equipment Breakdown: Coverage for damage from power surges or other storm-related issues.

Businesses require specialized coverage to protect against hurricane-related losses

Business insurance for hurricane risks requires careful consideration of all potential impacts on operations, not just physical damage to property.

Ensuring Adequate Protection

To ensure you have adequate hurricane protection:

- Review Your Policy: Understand your deductibles, coverage limits, and exclusions before hurricane season.

- Purchase Flood Insurance: Remember that standard policies don't cover flooding.

- Document Your Property: Keep an updated inventory and photos of your belongings.

- Mitigate Risks: Install storm shutters, reinforce your roof, and clear your property of potential debris.

- Consider Additional Coverage: Evaluate whether you need higher coverage limits or additional endorsements.

Being proactive about your hurricane coverage before a storm approaches is essential, as most insurers prohibit changes to policies once a hurricane watch or warning has been issued.

Conclusion: Comprehensive Protection for Hurricane Season

Hurricane insurance requires careful consideration of multiple coverage types, deductibles, and potential exclusions. By understanding these complexities and ensuring you have appropriate coverage for wind damage, water damage, and flooding, you can protect your home or business from the devastating financial impact of hurricanes.

As climate change continues to increase the frequency and intensity of hurricanes, having comprehensive coverage is more important than ever. Regular policy reviews and proactive risk management can help ensure you're prepared when the next storm strikes.