What would happen if you got into an accident while driving for Uber or Lyft during the time when your personal auto insurance and the rideshare company's insurance both deny coverage?

Understanding Ride-Sharing Insurance

Ride-Sharing Insurance is a specialized form of auto insurance designed to fill the coverage gaps that exist when using a personal vehicle for commercial ride-sharing services like Uber and Lyft. Most drivers are unaware that their standard auto insurance quotes and policies don't cover accidents that occur while driving for these platforms, creating potentially devastating financial exposure.

Rideshare drivers need specialized insurance coverage to protect against coverage gaps

The insurance landscape for rideshare drivers is complex because it involves multiple coverage periods and different types of policies. Understanding these nuances is essential for anyone considering or currently working as a rideshare driver to ensure they have adequate protection in all scenarios.

The Coverage Gap Problem

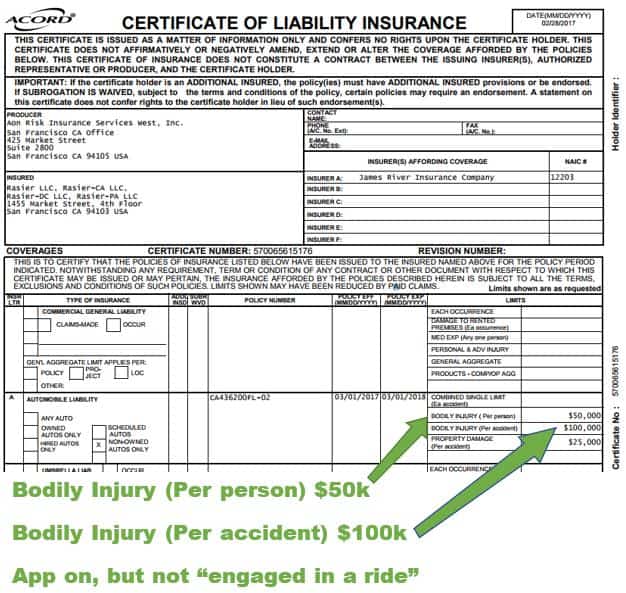

The primary challenge for rideshare drivers is the coverage gap that exists between personal auto insurance and the commercial insurance provided by rideshare companies. This gap occurs during what's known as "Period 1" – when the driver has the rideshare app turned on but hasn't yet accepted a ride request.

During this period:

- Most personal auto policies deny coverage because the vehicle is being used for commercial purposes

- Rideshare companies like Uber and Lyft provide only minimal liability coverage

- Drivers are left with significant financial exposure for accidents, injuries, or vehicle damage

This coverage gap is particularly dangerous because drivers spend considerable time in Period 1 while waiting for ride requests. Without proper rideshare insurance, a single accident during this time could result in devastating financial consequences.

Understanding the Four Periods of Coverage

Rideshare insurance needs to address four distinct periods of driving:

- Period 0: App is off – Covered by personal auto insurance

- Period 1: App is on, waiting for ride request – Coverage gap exists

- Period 2: Ride accepted, en route to pickup – Covered by rideshare company's commercial insurance

- Period 3: Passenger in vehicle – Covered by rideshare company's commercial insurance

While rideshare companies provide substantial coverage during Periods 2 and 3, many drivers mistakenly believe this protection extends to all driving activities. This misunderstanding can lead to serious coverage gaps and financial exposure.

The coverage limits during each period vary by state and rideshare company, but typically include:

- Period 1: $50,000 in bodily injury liability per person, $100,000 per accident, and $25,000 in property damage liability

- Periods 2-3: At least $1 million in third-party liability coverage

- Periods 2-3: Contingent comprehensive and collision coverage (with deductible)

Specialized Ride-Sharing Insurance Options

To address the coverage gap problem, insurance companies now offer specialized rideshare insurance products:

- Rideshare Endorsements: Add-ons to personal auto policies that extend coverage during Period 1

- Hybrid Policies: Comprehensive coverage that automatically adjusts based on whether you're driving personally or for rideshare

- Commercial Auto Insurance: Full commercial policies that cover all periods of rideshare driving

- For-Hire Livery Insurance: Commercial policies specifically designed for transportation services

Proper rideshare insurance documentation ensures drivers have coverage in all situations

These specialized options typically cost between $15-30 per month, a small price to pay for the peace of mind and financial protection they provide. Many major insurance companies now offer rideshare-specific products, making it easier than ever for drivers to obtain appropriate coverage.

Business Insurance Considerations

For drivers who treat rideshare driving as a business rather than occasional income, commercial auto insurance may be the most appropriate option. This type of business insurance provides comprehensive coverage for all aspects of rideshare driving and may offer additional benefits such as:

- Higher liability limits

- Loss of income coverage

- Specialized equipment coverage

- Business interruption protection

While commercial insurance is more expensive than personal policies with rideshare endorsements, it provides the most comprehensive protection for drivers who rely on rideshare as their primary source of income.

Choosing the Right Coverage

When selecting rideshare insurance, drivers should consider:

- Driving Frequency: How often you drive for rideshare services

- State Requirements: Minimum coverage requirements in your state

- Deductibles: Amount you'll pay out of pocket for claims

- Coverage Limits: Maximum amounts the policy will pay

- Exclusions: Specific situations not covered by the policy

It's also important to review the coverage provided by your rideshare company and understand exactly what is and isn't covered during each period. This knowledge will help you identify any remaining gaps in your coverage and select the most appropriate insurance product.

Conclusion: Protecting Your Rideshare Business

Ride-Sharing Insurance is an essential investment for anyone driving for platforms like Uber and Lyft. The coverage gaps that exist between personal auto insurance and rideshare company policies can create significant financial exposure, but specialized insurance products are available to address these vulnerabilities.

By understanding the different periods of coverage and selecting appropriate insurance, rideshare drivers can protect themselves, their passengers, and their financial future. As the gig economy continues to evolve, having the right insurance coverage is not just a legal requirement—it's a critical business decision that ensures long-term success and peace of mind.