As retirement planning evolves, annuity products are undergoing a remarkable transformation. Traditional annuities, once criticized for their complexity and limited flexibility, are being reinvented with innovative features that address modern retirees' needs for income security, growth potential, and adaptability. These new annuity options offer creative solutions to the fundamental retirement challenge: how to ensure you don't outlive your savings while still maintaining lifestyle flexibility.

The Evolution of Annuity Products

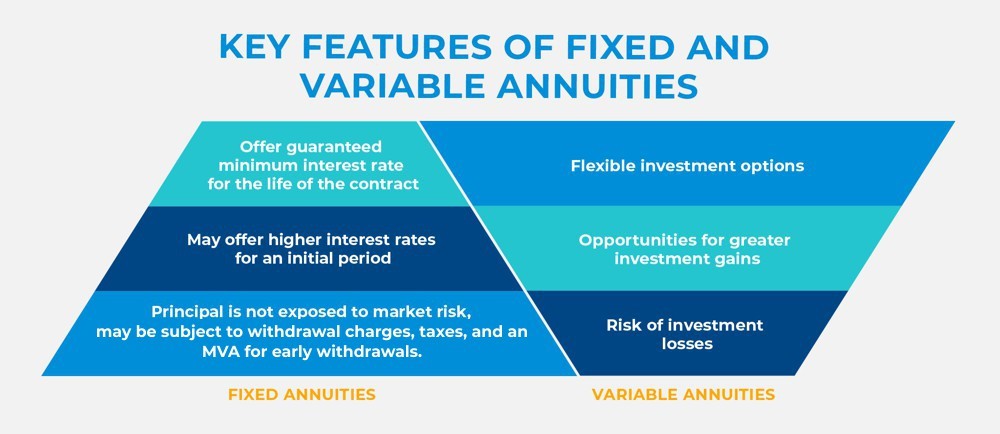

Traditional annuities have long been a cornerstone of retirement planning, offering guaranteed income streams in exchange for a lump-sum payment or series of payments. However, these products often came with significant limitations, including inflexible terms, high fees, and limited liquidity. In response to these drawbacks and changing retirement landscapes, insurance companies have developed innovative annuity products that combine the best features of traditional options with new, flexible features.

Today's annuity innovations focus on addressing key retirement concerns: longevity risk, market volatility, inflation, and changing income needs throughout retirement. These new products aim to provide retirees with greater control, transparency, and customization options than ever before.

Types of Innovative Annuity Products

The modern annuity marketplace offers several innovative options that cater to diverse retirement needs:

Benefits of Innovative Annuity Products

Modern annuity innovations offer several advantages over traditional options:

Enhanced Flexibility: New products often feature more flexible withdrawal options, allowing retirees to access their money when needed without excessive penalties.

Improved Transparency: Many innovative annuities offer clearer fee structures and more straightforward terms, making it easier for consumers to understand what they're purchasing.

Better Growth Potential: Index-linked and buffer annuities provide opportunities for market participation while still offering some level of protection against losses.

Customization Options: Riders and optional features allow policyholders to tailor their annuities to specific needs, such as long-term care coverage or inflation protection.

Tax Advantages: Certain annuity products offer tax-deferred growth or other tax benefits that can enhance retirement income efficiency.

Considerations and Potential Drawbacks

While innovative annuities offer many benefits, it's important to consider potential drawbacks:

Complexity: Despite improvements, some annuity products remain complex, with intricate terms and conditions that can be difficult to understand.

Fees and Expenses: Innovative features often come with additional costs that can impact overall returns. It's crucial to understand all fees associated with any annuity product.

Limited Liquidity: Many annuities still have surrender periods and withdrawal restrictions that limit access to your money, especially in the early years of the contract.

Inflation Risk: Unless specifically designed with inflation protection, fixed annuity payments may lose purchasing power over time.

Counterparty Risk: Annuities are only as secure as the insurance company backing them. It's essential to choose financially stable insurers with strong ratings.

Choosing the Right Annuity for Your Retirement

When selecting an annuity product, consider these factors:

The Future of Annuity Innovation

The annuity landscape continues to evolve, with several exciting developments on the horizon:

Digital Integration: Technology is making annuities more accessible and easier to understand, with online platforms offering simplified purchasing processes and transparent information.

Personalization: AI and data analytics are enabling more customized annuity solutions tailored to individual retirement needs and circumstances.

Hybrid Products: The line between different financial products continues to blur, with annuities incorporating features from investments, insurance, and banking products.

Regulatory Changes: Evolving regulations may lead to new annuity structures and consumer protections that enhance the value proposition of these products.

Final Thoughts

Annuity innovation is transforming retirement planning, offering new solutions to age-old challenges. These modern products provide retirees with more options than ever before for creating reliable income streams while maintaining flexibility and growth potential.

When considering annuities for your retirement strategy, it's essential to work with a qualified financial professional who can help you navigate the complex landscape and select products that align with your specific needs and goals. Remember that annuities are just one component of a comprehensive retirement plan, and the right approach often involves a diversified mix of products and strategies.

As with any financial decision, take the time to research thoroughly, understand all terms and conditions, and consider how an annuity fits into your overall retirement picture. With careful planning and the right innovative annuity products, you can create a retirement income strategy that provides both security and flexibility for the years ahead.