The insurance industry, traditionally characterized by complex processes, extensive paperwork, and multiple intermediaries, is undergoing a transformation through blockchain technology. This distributed ledger technology offers a new paradigm for secure, transparent policy management that addresses many of the industry's longstanding challenges. From auto insurance quotes to health insurance plans, blockchain is creating more efficient, trustworthy, and customer-centric insurance operations across all segments.

Understanding Blockchain in Insurance

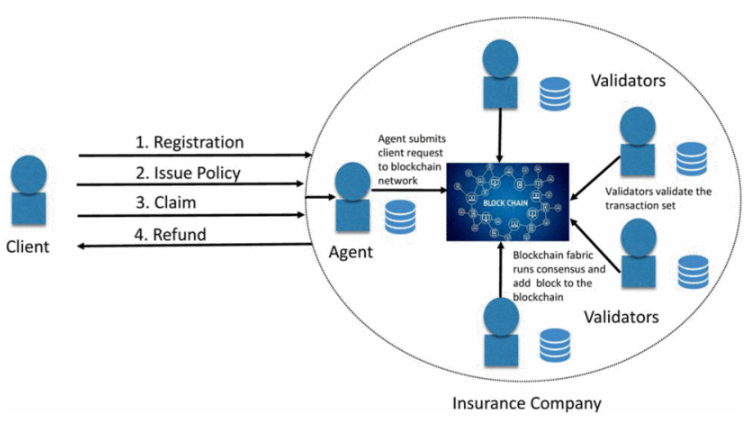

Blockchain is a distributed ledger technology that maintains a secure, decentralized record of transactions across multiple computers. Each transaction is recorded as a "block" and linked to previous blocks, creating an unchangeable chain of information. In insurance, this technology provides a shared, immutable record of policies, claims, and transactions that all authorized parties can access in real-time.

The fundamental properties of blockchain—decentralization, immutability, transparency, and security—address many pain points in traditional insurance operations. By eliminating the need for intermediaries and providing a single source of truth, blockchain reduces administrative costs, minimizes disputes, and enhances trust between insurers, policyholders, and other stakeholders.

How blockchain technology is transforming insurance processes through enhanced transparency and efficiency

Smart Contracts: Automating Insurance Processes

One of the most powerful applications of blockchain in insurance is smart contracts—self-executing agreements with the terms of the contract directly written into code. These contracts automatically execute when predefined conditions are met, without requiring human intervention.

In insurance, smart contracts can automate various processes including policy issuance, premium payments, and claims processing. For example, a travel insurance smart contract could automatically pay out if flight delay data from a trusted source exceeds a specified threshold. Similarly, parametric insurance for natural disasters could trigger automatic payments when verified weather data meets predefined conditions.

Smart contracts offer several advantages:

Speed: Claims can be processed and paid in minutes or hours rather than days or weeks.

Accuracy: Automated execution eliminates human error and ensures consistent application of policy terms.

Transparency: All parties can see the contract terms and execution history, reducing disputes.

Cost Reduction: Automation reduces administrative overhead and processing costs.

Enhancing Security and Fraud Prevention

Blockchain's immutable ledger and cryptographic security features make it an powerful tool for combating insurance fraud. Every transaction and claim is recorded permanently and cannot be altered without detection, making it extremely difficult for fraudsters to manipulate records or submit duplicate claims.

For cyber liability insurance, blockchain can provide an auditable trail of security incidents and responses, helping verify the legitimacy of claims. In health insurance plans, blockchain can help prevent fraudulent claims by providing a secure way to verify medical services and treatments across providers.

Blockchain also enhances data security through advanced encryption and decentralized storage. Unlike traditional centralized databases that present attractive targets for hackers, blockchain's distributed nature makes it significantly more resistant to cyber attacks, protecting sensitive customer information and insurance data.

Improving Transparency and Trust

One of the most significant benefits of blockchain in insurance is enhanced transparency. All authorized parties—insurers, policyholders, regulators, and other stakeholders—can access the same immutable record of transactions, eliminating information asymmetry and building trust.

For life insurance quotes and policies, blockchain can provide transparent records of policy ownership, beneficiary designations, and premium payments, reducing disputes during claims processing. In reinsurance markets, blockchain can create a shared view of risk exposure across multiple insurers, improving transparency and facilitating more efficient risk transfer.

This transparency extends to claims processing as well. All parties can track the status of a claim in real-time, from submission to settlement, reducing uncertainty and improving the customer experience. For complex claims involving multiple insurers or third parties, blockchain provides a single source of truth that eliminates disputes over claim details and payment responsibilities.

Applications Across Insurance Types

Blockchain technology is finding applications across virtually all insurance segments:

In property and casualty insurance, blockchain can streamline home insurance quotes and claims processing by providing verified property records, ownership history, and damage assessments. For flood insurance and earthquake insurance, blockchain can integrate with IoT sensors to automatically trigger claims when predefined conditions are met.

For auto insurance quotes and claims, blockchain can securely store vehicle history, maintenance records, and accident data, creating a trustworthy record that speeds up claims processing and reduces fraud. Telematics data can be securely stored on blockchain, enabling usage-based insurance models with transparent data collection and pricing.

In health insurance, blockchain can securely manage patient records, insurance claims, and provider networks, improving data interoperability while maintaining privacy. This applies to individual health insurance, family health insurance, and specialized plans like Medicare Advantage.

Business insurance benefits from blockchain through improved supply chain transparency, verified compliance records, and streamlined claims processing for commercial auto insurance, general liability insurance, and workers' compensation insurance.

Even specialized insurance products like pet insurance, wedding insurance, and drone insurance can benefit from blockchain's ability to provide secure, transparent records and automated claims processing.

Blockchain insurance process showing how customers, agents, validators, and insurance companies interact

Benefits for Insurers and Customers

Blockchain technology creates significant benefits for both insurers and customers:

Reduced Costs: Automation and elimination of intermediaries significantly lower administrative expenses.

Faster Processing: Smart contracts enable near-instant policy issuance and claims settlement.

Enhanced Security: Cryptographic protection and decentralization reduce fraud and cyber risks.

Improved Transparency: All parties have access to the same immutable record of transactions.

Better Customer Experience: Faster processes and greater transparency create more satisfying customer interactions.

New Product Opportunities: Blockchain enables innovative insurance products like parametric insurance and peer-to-peer coverage.

Challenges and Considerations

Despite its potential, implementing blockchain in insurance presents several challenges:

Technical Complexity: Blockchain implementation requires specialized expertise and significant technical resources.

Scalability: Current blockchain platforms may struggle to handle the high volume of transactions processed by large insurers.

Regulatory Compliance: Insurance regulations vary by jurisdiction and may not always accommodate blockchain-based solutions.

Integration with Legacy Systems: Many insurers operate on legacy systems that weren't designed to work with blockchain technology.

Industry Collaboration: Blockchain's full potential requires industry-wide standards and collaboration among competitors.

Data Privacy: While blockchain enhances security, balancing transparency with privacy protection remains a challenge, particularly for sensitive insurance data.

The Future of Blockchain in Insurance

As blockchain technology continues to mature, its impact on insurance will likely expand significantly. Future developments may include:

Industry Consortia: Insurers are forming industry-wide blockchain initiatives to establish common standards and platforms.

Integration with Other Technologies: Blockchain will increasingly be combined with AI, IoT, and other emerging technologies to create comprehensive solutions.

Parametric Insurance Growth: Blockchain-based parametric insurance products will become more common, especially for weather-related risks.

Tokenization of Insurance Assets: Insurance policies and risk pools may be tokenized, enabling new investment and risk transfer mechanisms.

Regulatory Evolution: Regulators are developing frameworks specifically for blockchain-based insurance, addressing current compliance challenges.

Conclusion

Blockchain technology is poised to transform the insurance industry by addressing fundamental challenges in security, transparency, and efficiency. By providing a secure, decentralized ledger for insurance transactions and enabling automated processes through smart contracts, blockchain creates more trustworthy, efficient, and customer-centric insurance operations.

From auto insurance quotes to health insurance plans, blockchain is enabling new approaches to risk management, claims processing, and customer engagement. While implementation challenges remain, the potential benefits are too significant to ignore. The insurers who embrace this transformation, investing in the necessary technology and collaborating across the industry, will be best positioned to thrive in the evolving insurance landscape.

As we look to the future, blockchain will likely become an integral part of the insurance technology stack, working alongside AI, IoT, and other innovations to create a more efficient, transparent, and responsive insurance ecosystem. The most successful insurers will be those that view blockchain not just as a technology upgrade but as a foundation for fundamentally reimagining how insurance works.