How are evolving risks and market conditions reshaping the commercial liability insurance landscape?

In today's rapidly changing business environment, commercial liability insurance continues to evolve to address emerging risks and market conditions. Businesses of all sizes rely on this essential coverage to protect against financial losses resulting from third-party claims of bodily injury, property damage, and personal injury. Understanding the current trends in coverage options and premium pricing is crucial for business owners looking to optimize their insurance strategies while managing costs effectively.

Average premium changes in commercial liability insurance over recent years

Current Market Trends

The commercial liability insurance market has experienced significant shifts in recent years. After a period of double-digit premium increases, the market has shown signs of stabilization, with rate increases moderating to more manageable levels. According to industry reports, most businesses are now seeing premium increases between 4% and 5%, a substantial improvement from previous years.

This moderation in rates reflects several factors, including improved underwriting practices, increased competition among carriers, and a better understanding of emerging risks. However, certain segments of the market continue to experience higher rate increases, particularly those with elevated risk profiles or significant claim histories.

Key Market Trend

The overall average premium increase across major commercial lines has held steady at approximately 4.9%, representing a significant softening compared to previous years of double-digit growth.

Factors Affecting Premium Pricing

Several key factors continue to influence commercial liability insurance premiums:

Industry and Business Type

High-risk industries such as construction, manufacturing, and healthcare typically face higher premiums due to increased exposure to potential claims.

Claims History

Businesses with a history of frequent or severe claims face higher premiums, while those with clean records may qualify for discounts.

Geographic Location

Regional factors such as legal environment, weather patterns, and local economic conditions can significantly impact premium pricing.

Business Size and Revenue

Larger businesses with higher revenues and more employees typically require higher coverage limits, resulting in increased premiums.

Risk Management Practices

Businesses with robust risk management programs and safety protocols may qualify for premium discounts.

Evolving Coverage Trends

As the risk landscape continues to change, commercial liability insurance coverage is evolving to address new and emerging threats:

Cyber Liability Integration

With the increasing frequency and sophistication of cyber attacks, many commercial liability insurance policies now include or offer endorsements for cyber-related risks. This integration reflects the growing recognition that cyber threats can lead to traditional liability claims, such as privacy breaches resulting in third-party damages.

Employment Practices Liability

Employment practices liability coverage has become increasingly important as workplace regulations evolve and social awareness of employment issues grows. This coverage protects businesses against claims of discrimination, wrongful termination, harassment, and other employment-related issues.

Environmental Liability

Growing environmental concerns and stricter regulations have led to increased demand for environmental liability coverage. This protection addresses claims related to pollution, contamination, and other environmental damages that may result from business operations.

Professional Liability Expansion

Professional liability insurance and errors and omissions insurance are expanding to cover a broader range of services and professional activities. This trend reflects the increasingly specialized nature of modern business operations and the growing complexity of professional services.

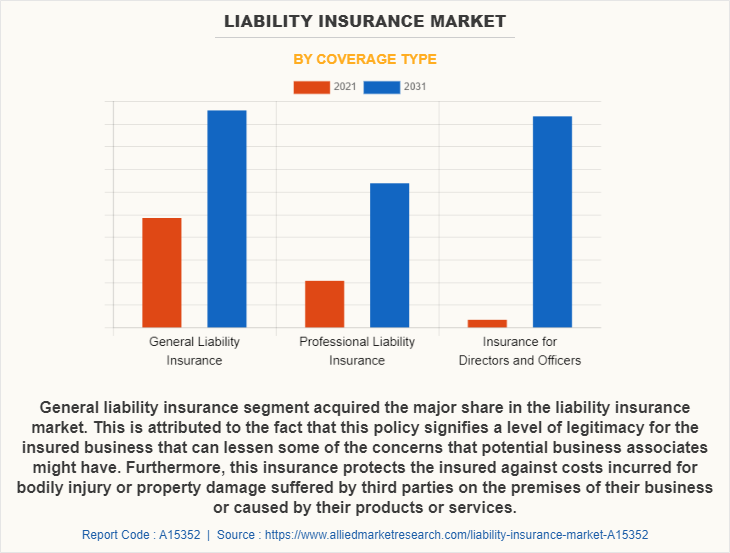

Market value of different liability insurance types showing growth in specialized coverage areas

Impact of Social Inflation

One of the most significant factors affecting commercial liability insurance is the phenomenon of social inflation—the tendency of courts and juries to award increasingly large damages to plaintiffs. This trend has contributed to higher claim costs and, consequently, higher premiums across many liability insurance lines.

Social inflation is driven by several factors, including:

- Changing societal attitudes toward corporations

- Increased litigation funding from third parties

- More plaintiff-friendly legal environments in certain jurisdictions

- Growing public awareness of corporate responsibility

Emerging Risks and Coverage Gaps

As businesses adapt to new technologies and operating models, new risks continue to emerge that may not be adequately covered by traditional commercial liability insurance policies:

Artificial Intelligence and Automation

The increasing use of AI and automation in business operations creates new liability exposures that traditional policies may not address. Questions of accountability when AI systems cause harm or make errors present complex coverage challenges.

Climate Change and Extreme Weather

While flood insurance and earthquake insurance address specific natural disasters, the broader impacts of climate change on business operations may create liability exposures not covered by standard policies.

Pandemic and Public Health Crises

The COVID-19 pandemic highlighted significant coverage gaps in traditional liability policies regarding business interruption and transmission-related claims. While some carriers have introduced new endorsements, coverage for future public health crises remains an evolving area.

Industry Insight

Many businesses are now complementing their commercial liability insurance with specialized coverages like cyber liability insurance and umbrella insurance to address emerging risks and coverage gaps.

Future Outlook

Looking ahead, several trends are likely to shape the future of commercial liability insurance:

- Continued premium moderation in most segments, with targeted increases for high-risk industries

- Greater integration of technology in underwriting and claims processes

- Increased demand for specialized coverage options tailored to specific industries and risks

- More emphasis on risk management and loss prevention as premium pricing factors

- Evolution of policy language to address emerging technologies and business models

Business owners should regularly review their commercial liability insurance policies to ensure adequate coverage

Strategic Considerations for Businesses

Given the evolving landscape of commercial liability insurance, businesses should consider the following strategies:

- Conduct regular risk assessments to identify emerging exposures

- Review policies annually to ensure coverage aligns with current business operations

- Invest in robust risk management and loss prevention programs

- Consider working with an insurance professional who specializes in your industry

- Evaluate the need for specialized coverages to address emerging risks

- Maintain comprehensive documentation of risk management efforts

Conclusion

Commercial liability insurance continues to evolve in response to changing market conditions, emerging risks, and societal trends. While premium increases have moderated in recent years, businesses must remain vigilant about their coverage needs and risk management practices. By staying informed about current trends and working with knowledgeable insurance professionals, businesses can ensure they have appropriate protection while managing costs effectively in this dynamic insurance environment.