How digital transformation is revolutionizing the insurance industry through mobile technology

In today's fast-paced digital world, insurance companies are increasingly leveraging mobile technology to enhance customer experience and streamline operations. Insurance mobile apps have become essential tools for policyholders, offering unprecedented convenience in managing auto insurance quotes, home insurance quotes, life insurance quotes, and health insurance plans. These applications are transforming how customers interact with their insurance providers, making it easier than ever to access services anytime, anywhere.

Modern insurance mobile apps provide intuitive interfaces for policy management

The Rise of Insurance Mobile Apps

The insurance industry has traditionally been characterized by paperwork, lengthy processes, and in-person interactions. However, the digital revolution has prompted significant changes, with mobile apps at the forefront of this transformation. Today's insurance apps offer comprehensive functionality that allows users to:

- View and manage multiple insurance policies in one place

- File and track claims with real-time updates

- Receive instant insurance quotes for various coverage types

- Make premium payments securely

- Access digital insurance cards

- Communicate with agents and support staff

Key Features of Modern Insurance Apps

Policy Management

Comprehensive tools to view, update, and manage all types of insurance policies including business insurance, renters insurance, and motorcycle insurance.

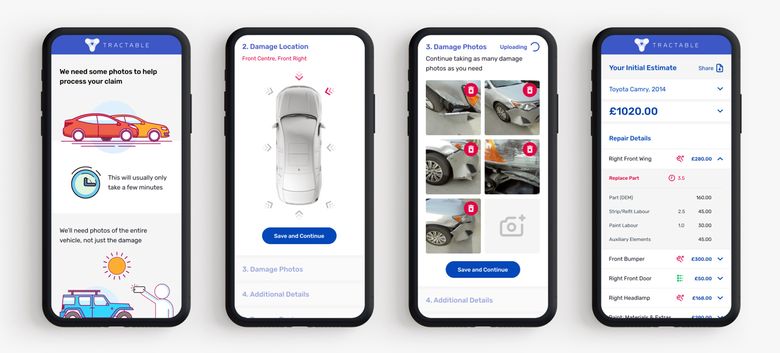

Digital Claims Processing

Streamlined claims submission with photo documentation, real-time tracking, and faster processing times for commercial auto insurance and other coverage types.

Secure Payment Options

Multiple payment methods for premiums with automatic reminders and flexible scheduling for all insurance types including travel insurance and pet insurance.

AI-Powered Support

Intelligent chatbots and virtual assistants provide instant answers to policy questions and claim status updates for disability insurance, long-term care insurance, and more.

Streamlining Claims Processing

One of the most significant benefits of insurance mobile apps is the dramatic improvement in claims processing. Traditionally, filing a claim involved paperwork, phone calls, and waiting periods. Mobile apps have transformed this experience by:

- Enabling instant claim filing with photo and video documentation

- Providing real-time status updates and notifications

- Facilitating direct communication with claims adjusters

- Offering digital document storage and retrieval

- Accelerating payment processing for approved claims

Mobile apps streamline claims processing with intuitive interfaces and real-time updates

Specialized Insurance Apps

While many insurance companies offer comprehensive apps covering multiple product lines, some specialized insurance types have dedicated mobile solutions:

- Flood insurance and earthquake insurance apps with disaster alerts and emergency resources

- Life insurance apps for managing term life insurance, whole life insurance, and universal life insurance policies

- Health insurance apps for finding in-network providers and managing Medicare plans

- Commercial insurance apps designed for business owners managing workers' compensation insurance and general liability insurance

The Future of Insurance Mobile Apps

As technology continues to evolve, insurance mobile apps are becoming increasingly sophisticated. Emerging trends include:

- Integration with IoT devices for real-time risk assessment

- AI-powered personalized recommendations for coverage

- Blockchain technology for enhanced security and transparency

- Voice-activated commands and virtual assistants

- Augmented reality for damage assessment and documentation

Insurance mobile apps have fundamentally transformed how policyholders interact with their coverage, offering unprecedented convenience, transparency, and efficiency. As these technologies continue to evolve, they will further streamline insurance processes, making it easier than ever for customers to manage their policies and file claims on the go.