Insurance premiums are the amounts policyholders pay for their insurance coverage, typically charged monthly, quarterly, or annually. These payments are essential for maintaining active insurance policies and provide the financial resources insurers need to pay claims. Understanding how premiums are calculated and what factors influence rate changes can help consumers make informed decisions about their insurance coverage and potentially find ways to reduce their costs.

How Insurance Premiums Are Calculated

Insurance companies use complex algorithms and actuarial science to calculate premiums. The basic formula considers the expected cost of claims plus administrative expenses, profit margin, and a contingency for unexpected events. Insurers start with a base rate for a particular type of coverage and then adjust it based on various risk factors specific to the policyholder and the insured item or person.

The calculation process varies by insurance type but generally follows these principles:

Risk Assessment: Insurers evaluate the likelihood of a claim occurring based on historical data and statistical models.

Exposure Evaluation: The potential size of a loss is considered, with higher exposure resulting in higher premiums.

Expense Loading: Administrative costs, commissions, and other business expenses are added to the pure premium.

Profit Margin: Insurers include a profit component to ensure financial sustainability.

Competition Factor: Market conditions and competitive pressures may adjust the final premium.

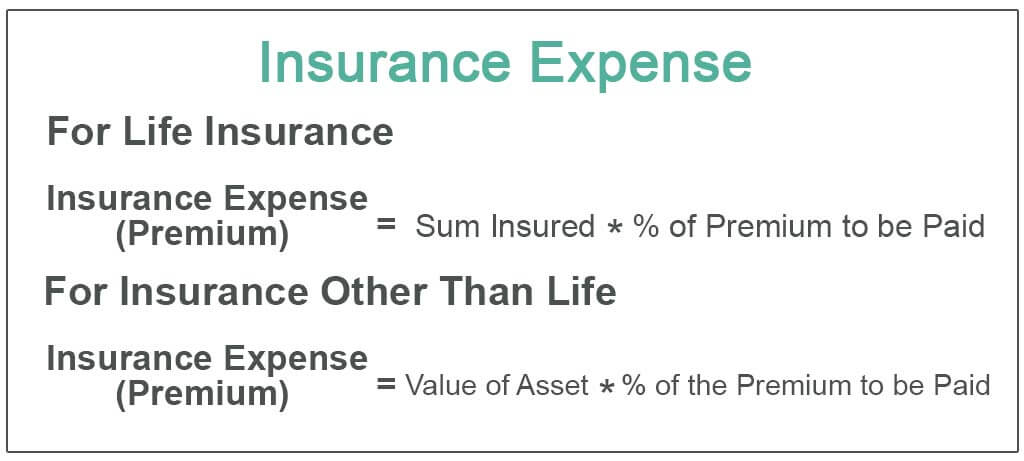

Insurance premium calculation formulas showing key components

Auto Insurance Premium Factors

Auto insurance quotes are influenced by numerous factors that assess both the driver and the vehicle. Personal factors include age, gender, driving record, credit history, and marital status. Younger drivers typically pay higher premiums due to their inexperience, while drivers with clean records enjoy lower rates. The type of vehicle also significantly impacts premiums, with luxury cars, sports cars, and vehicles with high repair costs generally resulting in higher auto insurance quotes.

Geographic location plays a crucial role in determining auto insurance rates. Urban areas with higher traffic density, crime rates, and accident frequency typically have higher premiums than rural areas. Annual mileage and primary use of the vehicle (personal vs. business) also affect rates, with more time on the road increasing the risk of accidents.

Coverage selections and deductible amounts directly impact premiums. Higher coverage limits and lower deductibles result in higher premiums, while increasing deductibles can reduce costs. Additionally, drivers can often qualify for discounts through defensive driving courses, safety features in their vehicles, bundling policies, or maintaining a claims-free history.

Home and Property Insurance Factors

For home insurance quotes, insurers consider the property's location, age, construction type, and replacement cost. Homes in areas prone to natural disasters like floods, earthquakes, or hurricanes will have higher premiums for flood insurance or earthquake insurance. The distance to the nearest fire department and fire hydrant also affects rates, as closer access to emergency services reduces potential damage.

The age and condition of the home significantly impact premiums. Older homes may have outdated electrical systems, plumbing, or roofing that increase risk, resulting in higher rates. Security features like alarm systems, deadbolt locks, and smoke detectors can qualify for discounts. The presence of potentially hazardous features such as swimming pools or trampolines may increase premiums.

Personal factors like credit history and previous claims history also affect home insurance quotes. Policyholders with good credit typically receive lower rates, while those with multiple claims may face higher premiums or difficulty obtaining coverage. For renters, renters insurance premiums are generally lower than homeowners insurance but are influenced by similar factors including location, property value, and personal claims history.

Life and Health Insurance Factors

Life insurance quotes are primarily determined by age and health status. Younger, healthier individuals pay lower premiums for term life insurance, whole life insurance, and universal life insurance. Medical conditions, family health history, and lifestyle factors like smoking or dangerous hobbies increase premiums. The type and amount of coverage also affect rates, with permanent policies typically costing more than term policies for the same death benefit.

For health insurance plans, premiums are influenced by age, location, tobacco use, and plan category. Under the Affordable Care Act, insurers can only consider these factors when setting rates for individual health insurance and family health insurance. Plan type (HMO, PPO, etc.) and coverage level (bronze, silver, gold, platinum) significantly impact premiums, with more comprehensive coverage resulting in higher costs.

For seniors, Medicare Advantage and Medicare Supplement premiums vary based on plan type, location, and additional benefits. Short-term health insurance typically offers lower premiums but provides less comprehensive coverage than traditional health plans.

Key factors that influence life insurance premium costs

Business Insurance Factors

Business insurance premiums are influenced by industry type, business size, location, and specific risk factors. Commercial auto insurance rates depend on vehicle types, usage patterns, driver records, and cargo carried. General liability insurance premiums are based on business type, size, location, and claims history.

For professional liability insurance and errors and omissions insurance, factors include profession, experience level, claims history, and coverage limits. High-risk professions like healthcare or legal services typically face higher premiums. Workers' compensation insurance rates are determined by industry classification, payroll size, and claims experience.

Cyber liability insurance premiums depend on business size, industry, data security measures, and previous incidents. Companies with robust cybersecurity protocols may qualify for lower rates. Specialized policies like product liability insurance are priced based on product type, sales volume, and safety record.

Why Insurance Rates Change

Insurance premiums are not static and can change for various reasons. Inflation significantly impacts insurance costs as the price of goods and services rises, increasing the costs associated with claims. For auto insurance, rising vehicle repair costs, medical expenses, and litigation expenses all contribute to premium increases.

Natural disasters and catastrophic events can cause widespread premium increases. After major hurricanes, wildfires, or floods, insurers may raise rates across affected regions to account for increased risk. Similarly, changes in weather patterns due to climate change are affecting flood insurance and earthquake insurance rates in many areas.

Regulatory changes can also impact premiums. New laws requiring additional coverage or changing how insurers assess risk can lead to rate adjustments. Technological advancements can have mixed effects—while safety features in vehicles may reduce some risks, the increasing complexity and cost of repairs can offset these savings.

Individual policy changes also affect premiums. Adding coverage, increasing limits, or reducing deductibles will increase premiums. Conversely, maintaining a claims-free record, improving credit, or qualifying for new discounts can help reduce costs.

Three primary reasons behind insurance premium increases

Managing Insurance Costs

While some factors affecting insurance premiums are beyond policyholders' control, there are several strategies to manage costs:

Shop Around: Compare quotes from multiple insurers to find competitive rates.

Bundle Policies: Combining multiple policies with one insurer often results in discounts.

Increase Deductibles: Raising deductibles can lower premiums, though it increases out-of-pocket costs for claims.

Maintain Good Credit: Many insurers use credit-based insurance scores in rate calculations.

Ask About Discounts: Insurers offer various discounts for safety features, professional affiliations, and more.

Review Coverage Annually: Adjust coverage as needs change to avoid overpaying for unnecessary protection.

Improve Risk Profile: Install security systems, maintain good driving records, and implement safety measures.

Conclusion

Understanding insurance premium pricing and the factors that influence rate changes empowers consumers to make informed decisions about their coverage. While some factors like age, location, and broad economic trends are beyond individual control, many aspects of insurance costs can be managed through careful planning, risk reduction, and strategic policy choices.

From auto insurance quotes to health insurance plans, from life insurance quotes to business insurance, the principles of premium calculation remain consistent: assessing risk, anticipating costs, and pricing accordingly. By understanding these principles and actively managing their risk profiles, consumers can ensure they have appropriate coverage while optimizing their insurance expenses.

As the insurance landscape continues to evolve with new technologies, changing regulations, and emerging risks, staying informed about premium pricing factors will remain essential for all insurance consumers. Regular policy reviews and open communication with insurance professionals can help ensure that coverage remains adequate and costs remain reasonable over time.