Traveling internationally opens up a world of experiences, but it also exposes you to unfamiliar healthcare systems and potential medical emergencies. International travel medical insurance serves as your safety net, providing essential coverage when you're far from home. Whether you're planning a short vacation, studying abroad, or embarking on an extended international journey, understanding your healthcare coverage options is crucial for protecting both your health and your finances.

Understanding International Travel Medical Insurance

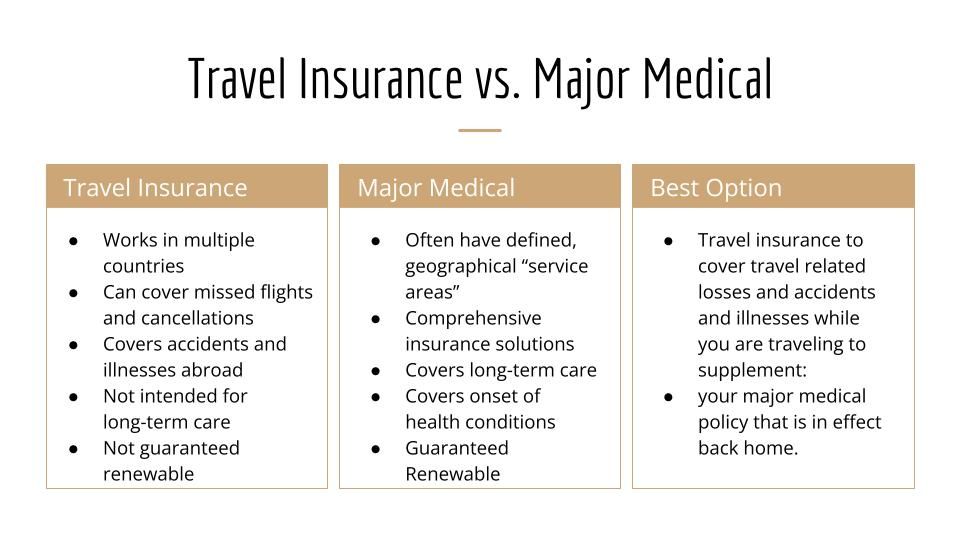

International travel medical insurance is specifically designed to cover healthcare expenses incurred outside your home country. Unlike domestic health insurance plans, which typically offer limited or no coverage abroad, international policies provide comprehensive protection for medical emergencies, evacuation, and other travel-related health concerns.

These policies typically cover emergency medical treatment, hospitalization, emergency medical evacuation, repatriation of remains, and sometimes dental emergencies. They may also include 24/7 assistance services that can help you locate appropriate medical facilities, arrange translation services, and coordinate care in foreign countries.

Why International Travel Medical Insurance is Essential

The importance of international travel medical insurance cannot be overstated, as domestic health insurance plans often provide little to no coverage outside your home country. Consider these critical reasons to secure appropriate coverage:

Types of International Travel Medical Insurance

Several types of international travel medical insurance cater to different travel needs and durations:

Single-Trip Insurance: Provides coverage for a specific journey, typically ranging from a few days to several months. Ideal for vacationers and business travelers on short international trips.

Multi-Trip or Annual Insurance: Covers multiple trips throughout the year, with each trip typically limited to a specific duration (usually 30-90 days). Perfect for frequent international travelers.

Long-Term Travel Insurance: Designed for extended international stays, typically ranging from six months to several years. Popular with expatriates, students studying abroad, and long-term travelers.

Immigrant Insurance: Tailored for new immigrants who are not yet eligible for domestic health insurance in their new country.

Group Travel Insurance: Covers groups of travelers, such as corporate teams, student groups, or tour parties, often at discounted rates.

What to Look for in an International Travel Medical Insurance Policy

When selecting international travel medical insurance, consider these essential coverage features:

Medical Expense Coverage: Look for policies with high coverage limits (at least $100,000 for short trips, $500,000+ for longer stays) that cover doctor visits, hospitalization, and medications.

Emergency Medical Evacuation: Ensure this coverage is included with adequate limits (typically $250,000-$500,000) to cover transportation to the nearest appropriate medical facility.

Repatriation of Remains: Covers the cost of returning your body to your home country in the unfortunate event of death abroad.

24/7 Assistance Services: Round-the-clock access to multilingual assistance coordinators who can help with medical emergencies, travel arrangements, and other needs.

Pre-Existing Condition Coverage: Some policies offer coverage for pre-existing conditions if purchased within a specific timeframe after making your first trip deposit.

Dental Coverage: Emergency dental treatment for relief of pain or injury, typically with coverage limits of $200-$500.

Comparing International Travel Medical Insurance Plans

Evaluating different international travel medical insurance options requires careful consideration of several factors:

Coverage Limits: Compare maximum benefit amounts for different types of coverage, particularly medical expenses and evacuation.

Deductibles and Coinsurance: Understand how much you'll pay out-of-pocket before insurance coverage begins and what percentage of costs you're responsible for.

Exclusions: Carefully review what's not covered, such as high-risk activities, pre-existing conditions, or specific destinations.

Provider Networks: Some policies have preferred provider networks, while others allow you to choose any medical facility.

Claims Process: Research how claims are handled—some require upfront payment with reimbursement later, while others pay providers directly.

Tips for Buying International Travel Medical Insurance

Follow these guidelines when purchasing international travel medical insurance:

Special Considerations for Different Types of Travelers

Different travelers have unique needs when it comes to international travel medical insurance:

Seniors: Older travelers should look for policies with higher coverage limits and consider pre-existing condition coverage. Some insurers offer specialized plans for seniors with age-appropriate benefits.

Students: Those studying abroad may need coverage that meets specific visa requirements and should consider plans that offer benefits like mental health coverage and tuition protection.

Families: Family plans often provide better value than individual policies. Look for coverage that includes childcare benefits if a parent becomes ill.

Business Travelers: Consider policies that offer benefits like business equipment replacement, trip interruption for work emergencies, and coverage for accompanying family members.

Adventure Travelers: Those engaging in high-risk activities should ensure their policies specifically cover these activities, as standard policies often exclude them.

Final Thoughts

International travel medical insurance is an essential investment for anyone traveling abroad, providing crucial protection against potentially catastrophic medical expenses. The right policy offers not just financial security but also peace of mind, allowing you to fully enjoy your international experiences without worrying about what might happen if you need medical care far from home.

When selecting coverage, prioritize comprehensive medical benefits, emergency evacuation, and reliable assistance services. Remember that the cheapest policy isn't always the best value—focus on coverage that aligns with your specific travel plans, health status, and destination.

Before departure, familiarize yourself with your policy details, including how to access emergency services and file claims. Keep your insurance information accessible throughout your journey, along with important contact numbers and policy documents.

With appropriate international travel medical insurance in place, you can explore the world with confidence, knowing you're protected against unexpected medical emergencies wherever your travels take you.