The Internet of Things (IoT) is revolutionizing the insurance industry by providing unprecedented access to real-time data about insured assets and behaviors. This network of connected devices—from telematics in vehicles to sensors in smart homes—enables insurers to move from reactive risk assessment to proactive risk management. By continuously monitoring conditions and behaviors, IoT technology is transforming how insurers evaluate risk, price policies, prevent losses, and engage with customers across all insurance segments, from auto insurance quotes to health insurance plans.

The IoT Revolution in Insurance

IoT technology represents a fundamental shift in how insurers interact with risk and customers. Traditionally, insurance has been based on historical data and generalized risk categories. IoT devices provide a continuous stream of real-time, individualized data about specific risks and behaviors, enabling more accurate risk assessment and personalized pricing.

This technology allows insurers to adopt a "predict and prevent" approach rather than simply paying claims after losses occur. By identifying potential risks before they materialize, insurers can help customers mitigate these risks, reducing claims frequency and severity while enhancing the customer experience through proactive, data-driven services.

The impact of IoT extends across the entire insurance value chain. For auto insurance quotes, telematics devices provide real-time data on driving behavior, enabling usage-based insurance models. For home insurance quotes, smart home sensors can detect potential issues like water leaks or fire hazards, allowing for preventive action before significant damage occurs.

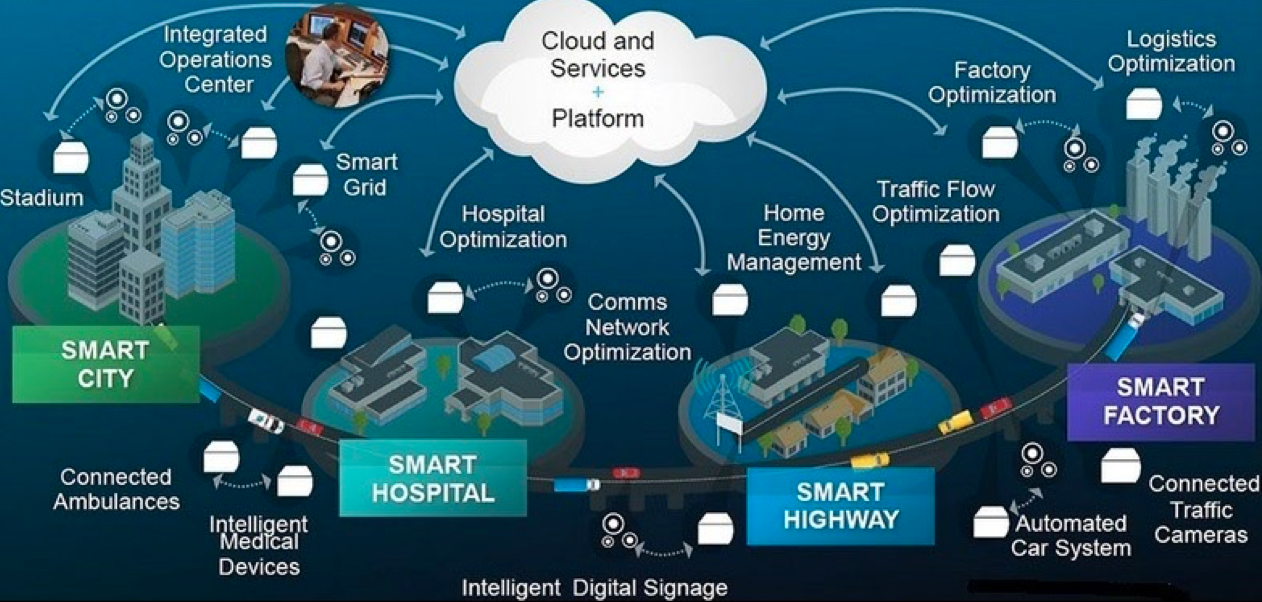

IoT connectivity transforming smart cities, healthcare, transportation, and industrial sectors

IoT in Auto Insurance

Auto insurance has been at the forefront of IoT adoption through telematics technology. These devices, installed in vehicles or accessed through smartphone apps, collect data on driving behavior including speed, acceleration, braking patterns, mileage, and time of day. This data enables insurers to:

Create usage-based insurance models: Premiums reflect actual driving behavior rather than demographic averages.

Provide real-time feedback: Drivers receive immediate feedback on their driving habits, helping them improve safety and potentially reduce premiums.

Accurately reconstruct accidents: Telematics data provides precise information about accident circumstances, speeding up claims processing.

Offer value-added services: Insurers can provide roadside assistance, vehicle health monitoring, and other services beyond traditional coverage.

Enable new insurance products: Telematics supports innovative products like pay-per-mile insurance for low-mileage drivers and specialized coverage for motorcycle insurance and RV insurance.

Smart Home and Property Insurance

IoT technology is transforming property insurance through smart home devices that monitor various risks and conditions. These connected devices include:

Water leak detectors: These sensors can identify leaks before they cause significant damage, reducing flood insurance claims.

Smoke and carbon monoxide detectors: Smart detectors can alert homeowners and emergency services immediately, potentially preventing catastrophic losses.

Security systems: Connected security devices can deter burglars and provide evidence for home insurance quotes and claims.

Temperature sensors: These devices can prevent frozen pipes and other temperature-related damage by alerting homeowners to dangerous conditions.

Smart appliances: Connected appliances can monitor for electrical issues that might lead to fires, reducing fire-related claims.

Connected smart home devices that enhance safety and enable real-time risk monitoring

IoT in Health and Life Insurance

Wearable devices and health monitoring IoT technology are creating new opportunities in health and life insurance. These devices track various health metrics including physical activity, heart rate, sleep patterns, and more. This data enables insurers to:

Offer wellness programs: Insurers can reward healthy behaviors with premium discounts on health insurance plans.

Provide more accurate risk assessment: Real-time health data enables more precise life insurance quotes and underwriting decisions.

Enable early intervention: Wearables can detect potential health issues early, allowing for preventive care that might reduce claims.

Create innovative products: IoT data supports new insurance products like critical illness insurance with monitoring features.

Support aging in place: Connected devices can help seniors live independently longer, potentially reducing long-term care insurance costs.

IoT in Business Insurance

Business insurance is also being transformed by IoT technology across various sectors:

In commercial property, IoT sensors can monitor equipment performance, environmental conditions, and security, helping prevent losses and enabling more accurate commercial property insurance pricing.

For workers' compensation insurance, wearable devices can monitor workplace conditions and employee safety, helping prevent injuries and reduce claims.

Cyber liability insurance benefits from IoT security devices that monitor network activity and detect potential breaches, enabling faster response and potentially reducing damage.

Supply chain insurance is enhanced by IoT tracking devices that monitor shipments in real-time, providing visibility into potential disruptions and enabling proactive risk management.

These applications help businesses reduce losses while providing insurers with more accurate data for underwriting and pricing various business insurance products.

Benefits for Insurers and Customers

IoT technology creates significant benefits for both insurers and customers:

More Accurate Risk Assessment: Real-time data enables more precise evaluation of individual risks rather than relying on broad categories.

Personalized Pricing: Premiums can be based on actual behavior and conditions rather than averages.

Loss Prevention: Early detection of potential issues enables preventive action before losses occur.

Enhanced Customer Experience: Value-added services and proactive engagement create stronger customer relationships.

Faster Claims Processing: IoT data can provide immediate evidence of loss circumstances, speeding up claims resolution.

New Revenue Streams: Insurers can offer value-added services beyond traditional insurance coverage.

Challenges and Considerations

Despite its many benefits, implementing IoT in insurance presents several challenges:

Data Privacy and Security: IoT devices collect vast amounts of personal data, raising significant privacy concerns. Insurers must implement robust security measures and be transparent about data usage.

Data Management: The sheer volume of data generated by IoT devices requires sophisticated infrastructure and analytics capabilities to process effectively.

Customer Adoption: Some customers may be hesitant to install IoT devices due to privacy concerns or perceived inconvenience.

Regulatory Compliance: Insurance regulations may not always keep pace with technological innovations, creating potential compliance challenges.

Integration with Legacy Systems: Many insurers operate on legacy systems that weren't designed to handle real-time IoT data, requiring significant investment in infrastructure upgrades.

The Future of IoT in Insurance

As IoT technology continues to evolve, its impact on insurance will only deepen. Future developments will likely include:

Advanced Analytics: AI and machine learning will enable more sophisticated analysis of IoT data, identifying subtle patterns and predicting risks with greater accuracy.

Expanded Device Ecosystem: The range and capabilities of IoT devices will continue to grow, providing even more comprehensive risk monitoring.

Blockchain Integration: Distributed ledger technology could enhance the security and transparency of IoT data sharing.

Hyper-Personalization: IoT data will enable truly individualized insurance products that adapt in real-time to changing conditions.

New Insurance Models: IoT will enable innovative insurance models like parametric insurance that pays out automatically when predefined conditions are met.

Conclusion

IoT technology is fundamentally transforming the insurance industry by enabling real-time risk monitoring and proactive loss prevention. By providing unprecedented access to data about insured assets and behaviors, connected devices are creating more accurate risk assessments, personalized pricing, and enhanced customer experiences across all insurance segments.

From auto insurance quotes based on actual driving behavior to home insurance quotes that account for smart home protections, IoT is enabling a more responsive, personalized, and valuable insurance ecosystem. The insurers who embrace this transformation, addressing privacy concerns while leveraging the full potential of connected devices, will be best positioned to thrive in the evolving insurance landscape.

As we look to the future, the line between insurance and other services will continue to blur, with IoT-enabled insurance becoming an integral part of a broader ecosystem of risk management and loss prevention services. The most successful insurers will be those that view IoT not just as a data source but as a foundation for fundamentally reimagining the value they provide to customers.