The insurance industry is at a critical juncture where outdated legacy systems are increasingly becoming barriers to innovation, customer experience, and operational efficiency. Legacy system modernization has emerged as a strategic imperative for insurers looking to remain competitive in today's digital-first landscape. This transformation involves upgrading or replacing aging technology infrastructure with modern, flexible, and scalable solutions that can support evolving business needs. From auto insurance quotes to health insurance plans, modernizing core systems is essential for insurers to deliver the speed, personalization, and efficiency that customers now expect.

The Challenge of Legacy Systems in Insurance

Legacy systems in insurance typically refer to outdated technology infrastructure that was developed decades ago using traditional architectures. These systems often include core policy administration, claims management, billing, and underwriting platforms that were built before the digital revolution. While these systems may have served insurers well in the past, they now present significant challenges:

Technical Limitations: Legacy systems often use outdated programming languages, proprietary architectures, and closed databases that make them difficult to integrate with modern technologies. They typically lack the flexibility to support new digital channels, mobile applications, and real-time data processing.

Operational Inefficiencies: Manual processes, siloed data, and batch processing are common in legacy systems, resulting in slow response times, high operational costs, and poor customer experiences. Simple tasks like updating a policy or processing a claim can take days or weeks instead of minutes or hours.

Innovation Barriers: The rigid nature of legacy systems makes it difficult and expensive to introduce new products, services, or business models. Insurers with outdated infrastructure struggle to keep pace with market changes and customer expectations for digital-first experiences.

Talent and Skills Gap: Finding developers with expertise in outdated technologies is increasingly difficult, creating maintenance challenges and security vulnerabilities as fewer professionals understand these aging systems.

Why Modernization Matters Now

The urgency for legacy system modernization in insurance has never been greater, driven by several converging factors:

Changing Customer Expectations: Today's insurance customers expect the same seamless digital experiences they receive in other aspects of their lives. They want instant auto insurance quotes, real-time claim status updates, and personalized interactions across multiple channels. Legacy systems simply cannot deliver these experiences at the speed and scale required.

Competitive Pressure: Insurtech startups and digitally-native competitors are leveraging modern technology to create innovative products and superior customer experiences. Traditional insurers with outdated systems risk losing market share to these more agile competitors.

Regulatory Changes: Evolving regulations in areas like data privacy, cybersecurity, and insurance distribution require systems that can adapt quickly to new compliance requirements. Legacy systems often lack the flexibility to accommodate these changes without expensive custom development.

Emerging Technologies: Artificial intelligence, IoT, blockchain, and other emerging technologies offer tremendous potential for insurance innovation, but integrating these capabilities with legacy systems is often technically challenging and expensive.

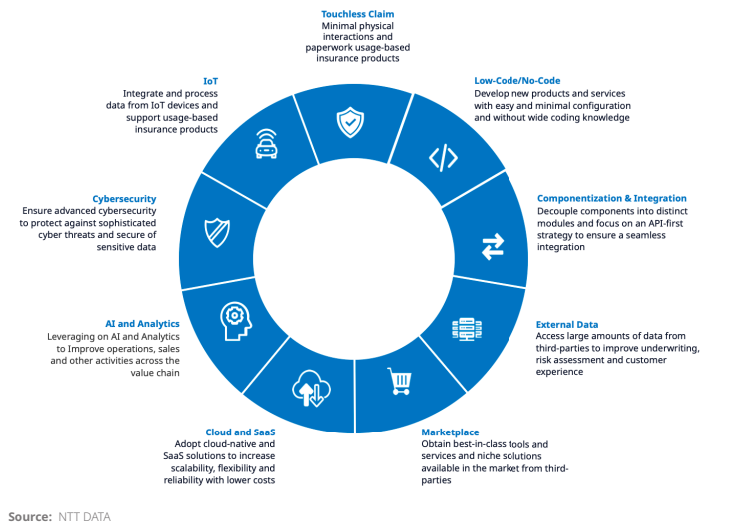

Key elements of insurance platform modernization and technology upgrades

Approaches to Legacy System Modernization

Insurers have several options when approaching legacy system modernization, each with its own benefits and considerations:

Complete Replacement: Replacing legacy systems entirely with modern, cloud-native platforms. This approach offers the greatest long-term benefits but requires significant investment and careful change management.

Phased Migration: Gradually replacing components of legacy systems over time, minimizing disruption to business operations. This approach spreads costs and risks but can create hybrid environments with their own complexities.

Wrapping and Extending: Building modern interfaces and capabilities around existing legacy systems, extending their functionality without replacing core components. This approach can deliver quick wins but may not address underlying architectural limitations.

Microservices Decomposition: Breaking down monolithic legacy systems into smaller, independent services that can be modernized individually. This approach allows for targeted modernization of high-value functions.

Platform-Based Solutions: Implementing modern insurance platforms that can gradually replace legacy functionality while maintaining business continuity.

Cloud-Native Transformation

Cloud-native architecture has become the preferred approach for legacy system modernization in insurance. This involves rebuilding systems using cloud technologies and principles like microservices, containerization, and DevOps practices. Cloud-native transformation offers several advantages:

Scalability: Cloud platforms can automatically scale resources up or down based on demand, ensuring optimal performance during peak periods without overprovisioning.

Agility: Microservices architecture enables independent development and deployment of different functions, allowing insurers to innovate faster and respond more quickly to market changes.

Cost Efficiency: Pay-as-you-go pricing models eliminate the need for large upfront infrastructure investments and reduce total cost of ownership.

Resilience: Distributed architecture with built-in redundancy ensures high availability and quick recovery from failures.

Innovation Enablement: Cloud platforms provide access to advanced services like AI/ML, big data analytics, and IoT integration without significant upfront investment.

Benefits Across Insurance Segments

Legacy system modernization delivers benefits across all insurance segments:

In property and casualty insurance, modernized systems enable more flexible home insurance quotes and policy management that can quickly adapt to changing risk models and regulatory requirements. For flood insurance and earthquake insurance, modern systems can integrate with real-time weather data and IoT sensors to provide more accurate risk assessment and pricing.

For auto insurance quotes and telematics, modernized systems can handle the massive volume of data generated by connected vehicles, enabling real-time risk assessment and personalized pricing. The scalability of modern platforms is particularly valuable for usage-based insurance models that process continuous streams of telematics data.

Life and health insurance benefit from modernized systems that can securely manage sensitive health data while providing the computational power needed for complex underwriting models. This applies to life insurance quotes, health insurance plans, and specialized products like Medicare Advantage and long-term care insurance.

Business insurance operations are enhanced through modernized platforms that can integrate with various business systems, providing comprehensive risk management solutions for commercial auto insurance, general liability insurance, and workers' compensation insurance.

Even specialized insurance products like cyber liability insurance, pet insurance, and travel insurance benefit from the flexibility and scalability of modernized systems.

Key aspects of digital transformation in insurance technology infrastructure

Enhancing the Customer Experience

Modernized systems directly enhance the customer experience through:

Faster Service Delivery: Customers can receive auto insurance quotes, policy documents, and claim payments in seconds rather than days.

Personalization at Scale: Modern analytics and AI capabilities enable highly personalized product recommendations and pricing based on individual customer data.

Omnichannel Experience: Modern platforms provide consistent experiences across web, mobile, and in-person channels, with real-time synchronization of customer data.

Self-Service Capabilities: Customers can manage their policies, file claims, and track progress through intuitive digital interfaces available 24/7.

Proactive Engagement: Modern systems enable insurers to analyze customer behavior and reach out with relevant offers and risk mitigation advice at the right time.

Challenges and Considerations

Despite its benefits, legacy system modernization presents several challenges:

Cost and Investment: Modernization requires significant upfront investment, which can be challenging to justify in the short term despite long-term benefits.

Business Disruption: Modernization projects can disrupt ongoing operations if not carefully planned and executed.

Data Migration: Moving data from legacy systems to modern platforms is complex and risky, requiring careful planning and execution.

Skills Gap: Modern technologies require specialized skills that may be scarce within traditional insurance organizations.

Cultural Resistance: Employees accustomed to legacy systems may resist changes to workflows and processes.

Regulatory Compliance: Modernized systems must comply with strict insurance regulations while supporting new digital capabilities.

The Future of Insurance Technology Infrastructure

As modernization efforts continue, the future of insurance technology infrastructure will be characterized by:

AI-Driven Operations: Artificial intelligence will be embedded throughout insurance operations, from underwriting and claims to customer service.

Composable Architecture: Insurers will build systems from interchangeable business capabilities, enabling even greater flexibility and innovation.

API-First Design: Systems will be designed with APIs as primary interfaces, enabling easy integration with partners and third-party services.

Real-Time Processing: Modern infrastructure will support real-time data processing and decision-making for enhanced customer experiences.

Quantum-Ready Systems: Future infrastructure will be prepared to leverage quantum computing for complex risk modeling and optimization.

Conclusion

Legacy system modernization is not just a technology upgrade—it's a fundamental transformation of how insurance companies operate, innovate, and serve customers. By modernizing their technology infrastructure, insurers can build more scalable, agile, and responsive operations that are better equipped to navigate the rapidly changing insurance landscape.

From auto insurance quotes to health insurance plans, modernized systems enable insurers to deliver more personalized, efficient, and valuable experiences to customers while reducing operational costs and increasing innovation capacity. The insurers who successfully modernize their legacy systems will be best positioned to thrive in an increasingly competitive and digital-first insurance market.

As we look to the future, modernized insurance technology will continue to evolve, incorporating emerging technologies like AI, edge computing, and quantum computing. The most successful insurers will be those that view modernization not as a one-time project but as an ongoing journey of continuous improvement and innovation.