When most people think of life insurance, they envision a safety net that provides for loved ones after they're gone. However, modern life insurance products have evolved into sophisticated financial tools that can play a pivotal role in retirement planning. By integrating life insurance into your retirement strategy, you can create a comprehensive financial solution that addresses multiple needs: protection, wealth accumulation, tax efficiency, and legacy planning.

Life Insurance as a Retirement Asset

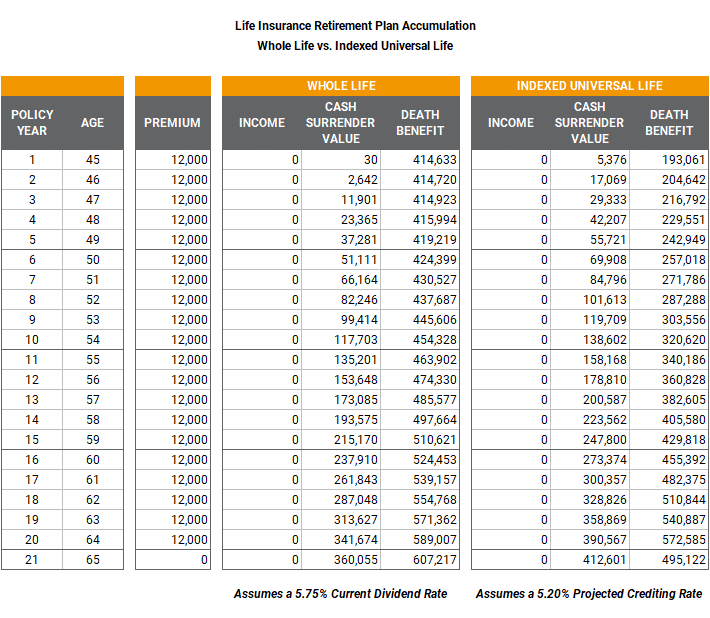

Certain types of life insurance, particularly permanent policies like whole life insurance and universal life insurance, build cash value over time that can be accessed during your lifetime. This cash value grows on a tax-deferred basis, similar to retirement accounts, but with additional benefits and flexibility that make it an attractive complement to traditional retirement savings.

Unlike retirement accounts with contribution limits and required minimum distributions, life insurance offers more flexibility in how and when you access your funds. This makes it particularly valuable for high-income earners who have maxed out other retirement savings options or for those seeking tax-efficient ways to supplement their retirement income.

Types of Life Insurance for Retirement Planning

When considering life insurance as part of your retirement strategy, several policy types offer distinct advantages:

Cash Value Accumulation and Access

The cash value component of permanent life insurance policies grows over time through premium payments and interest or investment returns. This accumulation occurs on a tax-deferred basis, meaning you don't pay taxes on the growth as long as it remains within the policy.

When you need to access these funds in retirement, you have several options:

Policy Loans: You can borrow against the cash value of your policy, typically at favorable interest rates. These loans are not taxable as income and don't require credit checks or repayment schedules.

Withdrawals: You can make withdrawals from your cash value up to your basis (the total amount of premiums paid) tax-free. Withdrawals beyond your basis are taxed as gains.

Surrender: You can surrender the policy for its cash value, though this terminates the coverage and may have tax consequences.

Tax Advantages of Life Insurance in Retirement

Life insurance offers several tax benefits that make it particularly valuable for retirement planning:

Tax-Deferred Growth: Cash value grows without being taxed annually, allowing for more efficient compounding over time.

Tax-Free Loans: Policy loans are not considered taxable income, providing a tax-efficient way to access funds.

Tax-Free Death Benefit: The death benefit is generally income tax-free to beneficiaries, providing an efficient wealth transfer tool.

No Required Minimum Distributions: Unlike traditional retirement accounts, there are no mandatory distributions at age 72, allowing you to maintain tax-deferred growth for longer.

Step-Up in Basis: If properly structured, the policy may receive a step-up in basis at death, potentially eliminating capital gains taxes on investments within the policy.

Wealth Transfer and Legacy Planning

Beyond providing retirement income, life insurance excels as a wealth transfer tool. The death benefit can:

Replace Lost Retirement Savings: If you need to use retirement assets for unexpected expenses before death, the life insurance death benefit can replace those funds for your heirs.

Equalize Inheritances: For business owners or those with illiquid assets, life insurance can provide liquid assets to ensure fair distribution among heirs.

Cover Estate Taxes: Life insurance can provide funds to pay estate taxes without forcing the sale of family assets or businesses.

Support Charitable Giving: Life insurance can be used to leave a meaningful legacy to charitable organizations while providing tax benefits.

Implementing Life Insurance in Your Retirement Plan

To effectively integrate life insurance into your retirement strategy, consider these approaches:

Considerations and Potential Drawbacks

While life insurance offers many benefits for retirement planning, it's important to consider potential drawbacks:

Higher Costs: Permanent life insurance typically has higher premiums than term insurance, with significant upfront costs.

Complexity: These products can be complex, with various fees, charges, and moving parts that require careful understanding.

Policy Loans: Outstanding policy loans at death will reduce the death benefit paid to beneficiaries.

Early Surrender Charges: Surrendering a policy in the early years may result in significant charges and potential tax consequences.

Performance Guarantees: Not all policies offer guaranteed returns, and market-linked policies may underperform expectations.

Final Thoughts

Integrating life insurance into your retirement planning can create a powerful financial solution that addresses multiple objectives: protection, wealth accumulation, tax efficiency, and legacy planning. When properly structured, life insurance can provide tax-advantaged growth, flexible access to funds, and a death benefit that supports both your retirement needs and your legacy goals.

As with any financial decision, it's essential to work with qualified professionals who can help you evaluate whether life insurance is appropriate for your situation and which policy type best aligns with your retirement objectives. A comprehensive financial plan that incorporates life insurance alongside other retirement savings vehicles can provide the flexibility and security needed to navigate the uncertainties of retirement with confidence.

Remember that the best retirement strategy is one that's tailored to your unique circumstances, goals, and risk tolerance. By exploring how life insurance can complement your existing retirement plan, you may discover opportunities to enhance your financial security and create a more robust foundation for your retirement years.