The insurance industry is experiencing a technological revolution in underwriting, the critical process of evaluating risk and determining policy terms and premiums. Traditional underwriting, which relied heavily on manual processes, paper-based documentation, and human judgment, is being transformed by digital solutions that enhance accuracy, speed, and consistency. From auto insurance quotes to health insurance plans, underwriting technology is reshaping how insurers assess risk, price policies, and serve customers across all insurance segments.

The Digital Underwriting Revolution

Digital underwriting represents a fundamental shift from traditional methods to technology-driven risk evaluation. This transformation is characterized by the integration of advanced technologies that automate routine tasks, analyze vast amounts of data, and provide underwriters with powerful tools to make more informed decisions. The result is a more efficient, accurate, and customer-friendly underwriting process that can handle increasing volumes of business while maintaining or improving risk assessment quality.

The impact of digital underwriting extends across the entire insurance value chain. For auto insurance quotes, digital platforms can instantly analyze driving records, vehicle information, and telematics data to provide accurate quotes in seconds. For life insurance quotes, digital solutions can process medical records, wearable device data, and other health information to assess risk with greater precision than ever before.

How artificial intelligence is transforming insurance underwriting processes

Key Technologies Transforming Underwriting

Several technologies are at the forefront of the underwriting revolution:

Artificial Intelligence and Machine Learning: AI algorithms can analyze complex patterns in historical data to predict future risks with greater accuracy. Machine learning models continuously improve as they process more data, enabling increasingly sophisticated risk assessments.

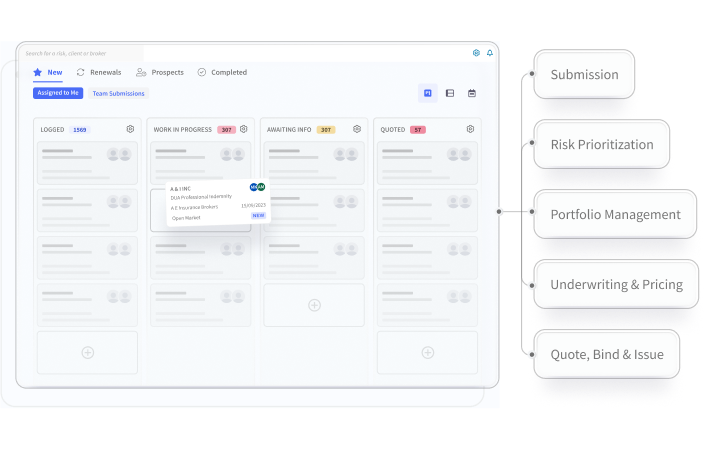

Digital Underwriting Workbenches: These integrated platforms provide underwriters with a unified view of all relevant data, analytics tools, and decision support systems in a single interface.

Robotic Process Automation (RPA): RPA bots handle repetitive tasks like data entry, document processing, and basic risk assessments, freeing human underwriters to focus on complex cases.

Internet of Things (IoT): Connected devices provide real-time data that can be used for more accurate risk assessment, from telematics in vehicles to smart home sensors.

Natural Language Processing: NLP can extract relevant information from unstructured documents like medical records, accident reports, and financial statements.

Applications Across Insurance Types

Digital underwriting solutions are transforming risk evaluation across virtually all insurance segments:

In property and casualty insurance, digital platforms can analyze satellite imagery, weather data, and property characteristics to assess risk for home insurance quotes, flood insurance, and earthquake insurance. For auto insurance quotes, telematics data and AI algorithms can create highly personalized risk profiles based on actual driving behavior.

Life insurance underwriting has been revolutionized by digital solutions that can process electronic health records, wearable device data, and genetic information to provide more accurate life insurance quotes. This has enabled innovations like no medical exam life insurance and more precise pricing for term life insurance, whole life insurance, and universal life insurance.

Health insurance underwriting benefits from digital systems that can analyze vast amounts of medical data, enabling more accurate risk assessment for individual health insurance, family health insurance, and specialized plans like Medicare Advantage and short-term health insurance.

Business insurance underwriting has been transformed through digital platforms that can analyze industry-specific data, financial records, and operational metrics. This applies to commercial auto insurance, general liability insurance, professional liability insurance, and workers' compensation insurance.

Even specialized insurance products like cyber liability insurance, pet insurance, and travel insurance are benefiting from digital underwriting solutions tailored to their unique risk factors.

Benefits for Insurers and Customers

Digital underwriting creates significant benefits for both insurers and customers:

Speed and Efficiency: What once took days or weeks can now be accomplished in minutes, dramatically reducing the time from application to policy issuance.

Improved Accuracy: Digital systems can analyze more data points and identify patterns that humans might miss, resulting in more accurate risk assessments and pricing.

Consistency: Automated systems apply underwriting rules consistently, reducing variability in decisions and ensuring fair treatment of similar risks.

Cost Reduction: Automation reduces the need for manual intervention, lowering operational costs for insurers.

Enhanced Customer Experience: Faster quotes, instant decisions, and personalized offerings create a better experience for insurance customers.

Expanded Coverage: By accurately assessing previously uninsurable or underinsured risks, digital underwriting can help expand access to insurance coverage.

Modern digital underwriting platform interface showing risk evaluation tools

The Human-Machine Collaboration

Despite the advanced capabilities of digital underwriting systems, the human element remains crucial. The most effective underwriting approaches combine the strengths of technology with human expertise and judgment. Digital systems excel at processing large volumes of data, identifying patterns, and applying consistent rules, while human underwriters bring contextual understanding, empathy, and the ability to assess complex or unique situations.

This collaboration takes various forms. Digital systems might handle straightforward applications automatically, flagging only complex cases for human review. Or they might provide underwriters with recommended decisions, risk scores, and supporting evidence, allowing humans to make the final determination. In either approach, technology enhances rather than replaces human expertise, creating a more efficient and effective underwriting process.

Challenges and Considerations

Implementing digital underwriting solutions presents several challenges:

Data Quality and Integration: Digital underwriting systems require access to high-quality data from various sources. Insurers must overcome data silos and ensure consistent data formats across systems.

Algorithmic Bias: AI models can inadvertently perpetuate or amplify existing biases in historical data, potentially leading to unfair or discriminatory outcomes. Insurers must carefully monitor and adjust their models to ensure fairness.

Regulatory Compliance: Insurance is heavily regulated, and digital underwriting systems must comply with all relevant regulations while maintaining transparency in decision-making.

Change Management: Transitioning from traditional to digital underwriting requires significant cultural change within organizations, as well as training and support for underwriters adapting to new tools and processes.

Integration with Legacy Systems: Many insurers operate on legacy systems that weren't designed for modern digital technologies, requiring significant investment in system upgrades or replacements.

The Future of Underwriting Technology

As technology continues to evolve, the future of underwriting will be characterized by even greater automation, personalization, and predictive capabilities. We can expect to see:

Predictive Underwriting: Advanced analytics will increasingly focus on predicting future risks rather than just assessing current ones, enabling more proactive risk management.

Real-Time Risk Assessment: With the proliferation of IoT devices and real-time data streams, underwriting will become increasingly dynamic, with risk assessments updated continuously.

Hyper-Personalization: AI will enable truly individualized insurance products that adapt to each customer's unique circumstances and changing needs.

Voice and Conversational Interfaces: Natural language processing will enable customers to interact with underwriting systems through voice commands and chat conversations.

Blockchain Integration: Distributed ledger technology could enhance transparency, security, and efficiency in underwriting processes.

Conclusion

Digital underwriting technology is not just improving the efficiency of insurance operations—it's fundamentally transforming how risk is assessed, priced, and managed. By leveraging advanced technologies to analyze vast amounts of data, insurers can create more accurate, personalized, and responsive insurance products that better meet the needs of modern customers.

From umbrella insurance to wedding insurance, digital underwriting is enabling more sophisticated risk assessment across all insurance segments. The insurers who embrace this transformation, focusing on ethical implementation and human oversight alongside technological innovation, will be best positioned to thrive in the evolving insurance landscape.

As we look to the future, the line between underwriting and other insurance functions will continue to blur, creating new opportunities for innovation and value creation. The most successful insurers will be those that view digital technology not as a replacement for human expertise but as a powerful tool to enhance it, creating a more efficient, accurate, and inclusive insurance industry for all.